Insurance: Cross Entity Claims Settlement

Allianz adopts Luthers platform for Deep Process Automation at scale to automate the complex and critical process for motor insurance.

Introduction

As a world's leading insurance company, and a market leader in motor insurance, Allianz has the potential to use its global reach to provide an unrivalled customer experience. A claim by an Allianz customer could be handled seamlessly anywhere across the Allianz network. With tens of thousands of cross entity claims submitted annually, amounting to hundreds of millions in value, this should be a competitive advantage.

Process Complexity

Allianz provides vehicle insurance policies for its EU customers, which provides coverage for any accidents across Europe. These policies are usually sold by an individual Operational Entity which covers the customers for any incidents as they travel across the Allianz network (to other regions covered by other entities). This process can happen between any 2 of the entities across the 23 entities.

However, this had become a difficult to manage set of largely manual processes that were different in every entity across the Allianz network. The absence of standardization made settling international claims expensive and prone to error and rework. What should have taken days was taking months and as a result, the customer experience fell short of Allianz's aspiration to provide customers with a fast and simple experience. The process involves numerous people working on each step for several weeks. This requires bespoke documents as there are multiple data formats and documents in place between the various countries. These teams spend a considerable portion of their time performing manual tasks on these docs. These problems are amplified by the fact that there are operating entities across 23 countries in the enterprise, each with their own documents and formats, which form a web of multiple manual bilateral interactions between the different pairs of European entities. This complicates and prolongs the settlement process, ultimately leading to high costs and high outstanding debts.

Solution

To build the world's best international claims process, best for customers and for Allianz, required automation that could handle the inherent complexity of a multi-entity process involving hundreds of Allianz people. It was equally important that the new process could be built by Allianz's own developers and changed easily when regulation changed in any of Allianz's markets or when Allianz expanded into new markets. This was far beyond the scope of traditional workflow automation tech which provides process automation for workflows with tens of tasks and one or two separate operational participants. Furthermore, connecting and coordinating multiple instances of workflow automation presents a number of challenges, including much longer development time, far less efficient code, limited permissioning for different users, limited visibility, and maintenance overhead.

This is why Allianz used Luther’s platform to automate and operate the mortgage and insurance sourcing process. The platform provided Allianz with the operating system to run the process while providing the rails for orchestrating, executing and monitoring their complex workflows. It also gave them the development tools to achieve rapid development times.

Together Allianz & Luther developed a new product that uses Deep Process Automation to:

- Make Allianz "one company" across 23 entities

- Bring together all the components of the international claims settlement process into one unchangeable ‘record of events’

- Express claims settlement journey in one business process script (smart contract), standardising data, documents and processes across Allianz entities

- Incorporate business and compliance rules at each step of the workflow, while allowing claims to be handled using local expertise with all data visible to and connected with the owning entity

- Connect multiple legacy systems to a common platform & script (smart contract)

In order to develop this product, Luther worked with Allianz subject matters experts to develop detailed process maps and identify all the participants involved:

- 23 Allianz entities, any pair of which must be able to involve the following teams:

- Claims handling team

- Finance team

- Payment team

Each of these participants plays a specific role in the end-to-end claims settlement process which can be seen as a series of logical tasks and business rules. The participants continue to use their local systems (e.g. Claims management system, Finance system) which are connected to the common network via APIs and Oracles. While every participant remains free to shape their respective operations (e.g. local customer service) and to decide how to best perform their duties, the ICS product ensures that all participants share a common set of scripts (smart contracts) running on a network of blockchain peers for critical interdependent process steps. These scripts act as guardrails for the operations while leaving a transparent and tamper-proof trail for auditability.

The smart contracts specifically developed for this product cover 3 domains: Claims, Worklist, and Billing. Claims smart contracts include local reference numbers, coverage details, liability, and accident details. They keep each OE’s internal systems in sync with each other, by establishing a common source of truth. The Worklist domain tracks issues and manages tasks that are assigned to claims handlers to ensure specific actions are performed on a claim. Finally, Billing includes multiple payments for each claim and manages cut-through workflows for small bills and bill batching.

Further technical documentation is available on request to detail how smart contract and data validations are developed, orchestrated and executed on the Luther platform. Please find a demo of the solution here.

Results

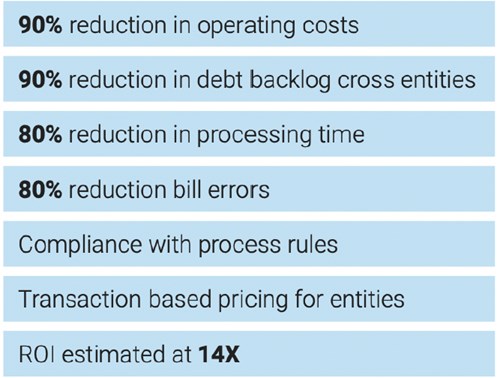

The partners have rapidly developed a world-leading claims settlement product which now provides the operating system for Allianz's international claims business. Thanks to this transformative initiative, claims are settled faster and cheaper with a sharp increase in customer satisfaction.

The team has enabled Allianz to tackle the mounting intercompany debt as a result of existing processes being cumbersome and unstandardised, such that intercompany debt is now negligible. Allianz's potential competitive advantage of operating across numerous markets has become a reality.

The modern ICS architecture is estimated to deliver millions of savings every year thanks to operational automation, reduced average claim processing time and increased capital leverage due to faster claim settlement. The modern ICS network allows for autonomous and separate operation of the Operating Entities while providing standardised operations and processing of claims as well as billing settlement between the 23 operating entities with documentless sharing of data and information.